Recently, more foreign investors possess real estate in Japan. From rental offices to accommodation facilities, stores, and houses, various types of real estate are what they invest in, which makes it not uncommon today that people rent a property from owners living abroad. And here, one thing to remember. A tenant who rents a rental property from owners abroad may need to deduct and pay withholding taxes from the rent. But do you know who is required this? and how? It is rather complicated to find in what cases need the tax-withholding, so having the basic information with some examples will help understand the possibilities.

Withholding tax on rental income

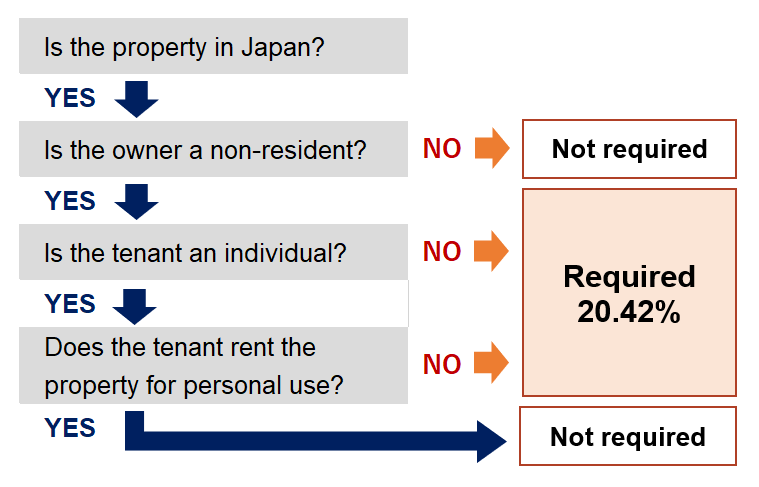

Withholding tax on rental income means paying a tax deducted from a rental fee for real estate owned by a non-resident. The tenant is to pay the tax to the local government in Japan on behalf of the non-resident owner. The taxation is 20.42% that includes “Income tax and Special income tax for reconstruction.” (所得税及び復興特別所得税)

In what cases are tax withholding required?

In terms of renting a rental property from a non-resident owner, the tenant may need to deduct and pay the withholding tax on rent. The non-resident denotes a person/corporation with no fixed abode/address in Japan or those who haven’t continuously lived in Japan for over one year. For example, a foreign investor abroad or a Japanese business person residing outside of Japan for more than one year are non-residents. A foreign corporation is also defined as a non-resident.

In addition, the need of the withholding is determined depending on two of the following conditions;

– Whether the tenant is an individual or corporation

– Whether the purpose of renting is for personal use or business use.

、

For a personal contract for personal use, tax-withholding is not required.

If an individual rents a property for personal use, tax-withholding is not required. For example, if you rent a house to use it as your residence or relatives’ residence, it is considered personal use. In this case, the property owner can receive the rent with no tax deducted.

In the case of business use, tax-withholding is required even for a personal contract.

If a tenant is an individual who rents a property for business use, such as a rental office and store, the tax is to be deducted from the rent and paid to Japan’s local tax office. The taxation is applicable to even a house used as an office and parking garage to park automobiles for business use. In this case, the property owner is to receive the rent after deducting the tax.

Example: An individual rents an office and pays the rent to the non-resident owner after deducting tax.

If you rent a house to use as both office and residence, the tax applies to the area used as an office. The office area’s proportion is determined when the tenant signs up a lease contract, and the tax is calculated and paid accordingly.

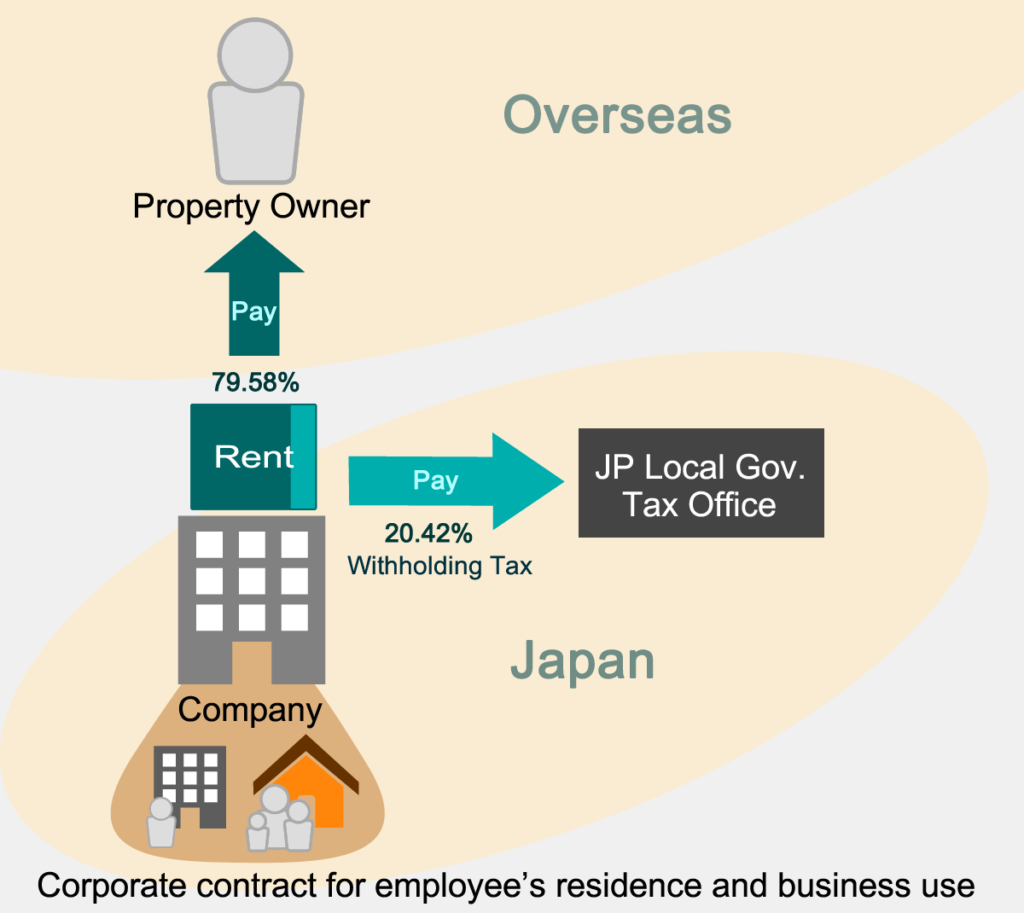

If a tenant is a corporation, tax-withholding is always required.

No matter the purpose of use, the tax must be deducted if a corporation rents rental properties from a non-resident owner. For example, if a corporation leases housing for employees and their families, tax-withholding is required.

Example: A company rents houses for employees and pays rent to the non-resident owner after deducting tax.

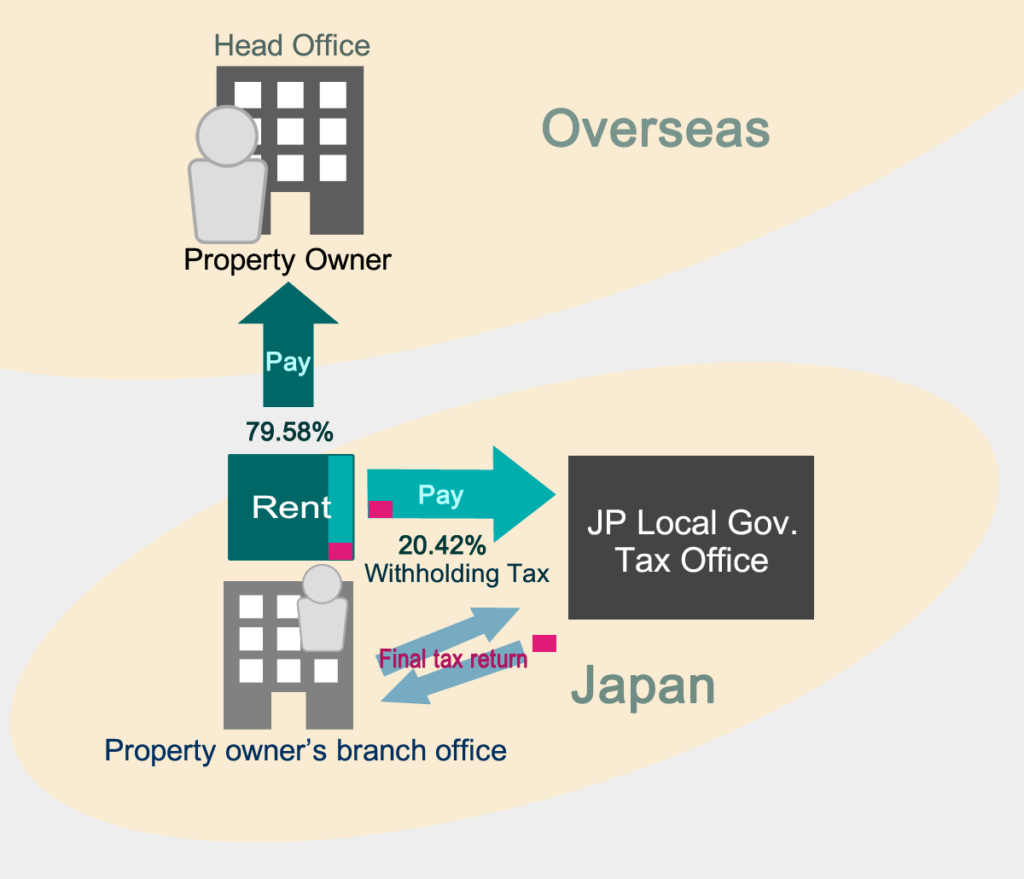

Exemption from withholding by individual/corporation

Even for renting business-use properties, tax-withholding may be exempt in the case that the non-resident owner/foreign corporation has a permanent establishment (PE) in Japan. Though the definition of PE varies in each country, PEs will include facilities such as factories, branch offices, and warehouses. The requirements for exemption are that a rental fee paid by a tenant is for the use of the PE, and the non-resident owner receives a “Certificate of Exemption from Withholding” (源泉徴収免除証明書) from the local tax office in Japan and then give it to the tenant. After the tenant pays the tax on behalf of the owner, the overpaid tax will be settled at the stage when the PE’s owner files its final tax return (complete an annual report) in Japan.

Example: Tax-drawing by the lease contractor who uses a branch office in Japan and pay the rent to a foreign corporation (Head office)

Also, in the case that you rent a property from a non-resident owner who lives in a country that has concluded a tax treaty with Japan, you will be allowed to have an exemption/reduction from paying the withheld tax. To receive the exemption, it requires the owner to file a “Tax treaty notification form” (租税条約届出書) and a prescribed application form through the payer (renter) by the day before the payment date.

In any case, it is advisable to consult a tax specialist to filing taxes correctly as the way of tax withholding will vary depending on the conditions; owner’s residential country, types or use of rental properties, and the state of lease contracts, etc.

How to pay withholding tax

The taxation is 20.42% of a rental fee, which comprises of “Income tax and Special income tax for reconstruction” (所得税及び復興特別所得税). A tenant is to pay the tax on behalf of the non-resident owner.

For example, if a tenant rents an office with rent at 1 million JP Yen/mouth;

The tax is calculated as;

1 million JPY x 20.42% = 204200 JPY

The amount that the tenant pays to the owner is;

1 million JPY – 204,200 JPY = 795800 JPY

NOTE: The calculation above is simplified and excludes consumption tax that is usually applied to rental properties for business use.

In principle, the withheld tax must be paid by the 10th of the month following the month in which rent was paid. The payment is made at the local tax office in Japan, offline or online (e-Tax www.e-tax.nta.go.jp), by submitting a required statement*. You can also pay at a bank or a convenience store.

*Statement (Tax Payment Slip) of Collected Income Tax.”(所得税徴収高計算書(納付書))is available at local tax offices.

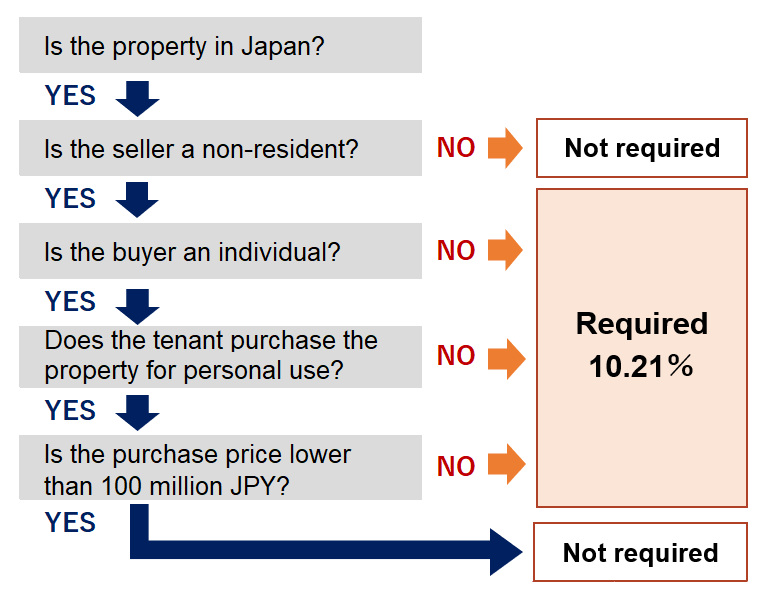

Extra information: What if in case of buying a property from a non-resident seller?

Similar to the case of a property lease from a non-resident owner, tax-withholding is required if an individual buys real estate from a non-resident owner/foreign corporation. The tax rate is 10.21% (Income tax and Special income tax for reconstruction) of the purchase price, and the buyer is required to pay the withheld tax to the local tax office in Japan. However, withholding is not required if the purchase price is less than 100 million yen and the buyer’s purpose of purchase is for his/her own or his/her relatives’ residence.

Related Information

Information by National Tax Agency JAPAN

Withholding Tax

https://www.nta.go.jp/english/taxes/withholing/index.htm

Withholding Tax Guide (Issued in 2019)

https://www.nta.go.jp/publication/pamph/gensen/shikata2019/pdf/16.pdf

List of tax treaty signatory countries (Japanese)

https://www.nta.go.jp/about/introduction/torikumi/report/2003/japanese/tab/tab31.htm