When purchasing a real estate property, there will be additional costs – taxes and service fees, other than the purchase price. The total cost varies significantly depending on the property type and the purpose of the purchase, so you need to consider the charges when making up your purchase plan. Here summarized with sample lists are the associated costs and how to estimate them, which helps you estimate how much the overall cost will be on your purchase.

- Costs associated with purchasing a real estate property

- The costs required to pay separately three times

- – 1 – Up-front cost required at the time of signing

Costs associated with purchasing a real estate property

The costs arising in purchasing a house/condominium are for closing the transaction, mostly including taxes and recording fees. You will pay these expenses generally three times; at the time of signing, at the time of settlement, and after the purchase. The costs to pay at each are described in the following lists with numbers (e.g., 1-1, 1-2), also indicated in the sample tables.

As a rule of thumb, in the case of purchasing a property in cash, the overall costs (registration, broker commission, and other fees) will roughly be 4% to 6% of the property’s price. For example, if you purchase a 100-million-yen condominium in cash, you will expect to pay 4 to 6 million yen as the cost of your purchase. As for purchasing on loan, the estimated cost will be about 5% to 7% of the property’s price.

The costs required to pay separately three times

Up-front cost required at the time of signing

- (1-1) Stamp duty

- (1-2) Broker commission

Closing cost (required at the time of settlement)

- (2-1) Registration fees(Registration and license tax, Legal service associated fees

- (2-2) Broker commission

- (2-3) Liquidation expenses (Maintenance fee, Repair fund, Property tax)

- (2-4) Loan administration fees (*If you take out a loan)

Cost to pay after purchase

- (3-1) Real estate acquisition tax

– 1 – Up-front cost required at the time of signing

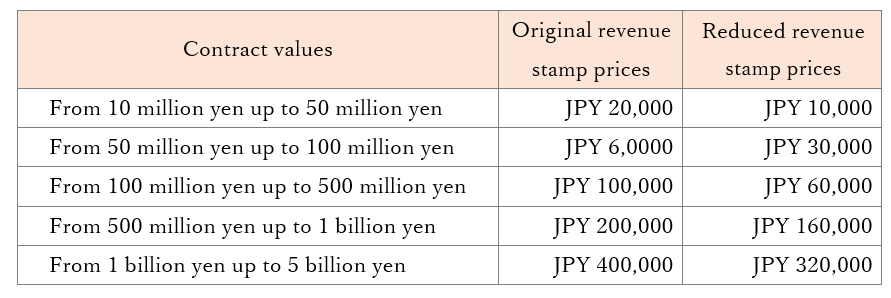

(1-1) Stamp duty

A revenue stamp is required on the buy-sell agreement. The stamp duty is determined by the sales price of the contracted property.

Reductions on the revenue stamps

A special mitigation measure by the government allows you to reduce the stamp duty for real estate sales contracts concluded between April 1, 2014, and March 31, 2024. The stamp prices are referred to in the following table.

Original/Reduced prices of revenue stamps:

(1-2) Broker commission

There is a service fee for signing a buy-sell agreement and other associated procedures. The brokerage fee is generally 3% of the transaction amount with an extra 60000 yen of a fixed price, then a 10% consumption tax is added to that total fee.

The broker commission is paid separately two times. The half amount is paid when signing the agreement, and the rest is at the time of the settlement.

– 2 – Costs incurred at the time of the settlement/delivery

(2-1) Registration fees (Registration and license tax, Legal service associated fees)

The registration is done to transfer the property ownership from the seller to the buyer. The cost of registration includes a Registration and license tax (登録免許税) and a legal fee paid to the judicial scrivener. The registration tax is calculated by multiplying the tax basis amount of each land/building by a specific tax rate. Specifically, the registration taxes required for ownership transfer are;

2% of the tax base amount for a land

2% of the tax base amount for a building

(As of July 2022)

For the transfer registration, another tax relief measure can be applied under a condition. If you purchase a primary residence or a house for your own residential purpose, you can receive a tax relief that allows a lower tax rate to calculate the registration and license tax. For example, in the case of owner transfer registration for a used house, the reduced tax rate is 1.5% of the tax basis amount of the land and 0.3% for that of the house. One thing to remember is that you need to fulfill requirements to receive this mitigation, such as the floor area of your residential house must be 50 m2 or more. This mitigation measure for those individual houses will be good until March 31, 2024.

Source: National Tax Agency JAPAN website (PDF) *Japanese website

https://www.nta.go.jp/publication/pamph/sonota/0020003-124_01.pdf

(2-2) Broker commission

The rest of the commission you paid half when signing is paid at the time of settlement.

(2-3) Liquidation expenses (Maintenance fee, Repair fund, Property tax)

You need to settle the expenses that the seller has already paid under the former ownership. The expenses include Maintenance fee 管理費, Repair fund 修繕積立金, Property tax (fixed-asset tax) 固定資産税.

Maintenance fee 管理費

The maintenance fee is used for maintenance and inspections of common-use facilities, such as an elevator and entrance hall. This monthly expense is required for all the residents(owners) in an apartment or condominium. The fee amount is determined by a resolution at the association board member’s meeting and may vary if necessary.

Repair fund 修繕積立金

All the residents(owners) in an apartment or condominium are required to fund a certain amount on a monthly basis through the association, prepared for expected repairment in the near future. Similar to the maintenance fee, the fund amount may vary depending on the circumstance.

Property tax (fixed-asset tax) 固定資産税

Property tax is on fixed assets – land and a house. The tax rate is 1.4% of the taxable base amount, which is reviewed every three years in accordance with fluctuations in the land value, meaning that the tax amount you will pay is not always the same every year. Also, the property tax is a local tax payable at a specific time of the year, designated by the city you live in. In Tokyo prefecture, the tax amount to pay is determined/notified in April and requires the payment separately four times in a fiscal year, June, September, December, and February.

(2-4) Loan administration fees (*Required if you take out a loan)

Taking out a loan from a financial institution requires a mortgage (or revolving mortgage) registration, which entails costs such as the recording fee, legal services fees to pay to a judicial scrivener, etc.

In purchasing a primary house on loan, you may receive a reduction in the mortgage registration tax. If your house fulfills specific requirements, such as if the floor area is 50 square meters or larger, the mortgage tax rate can be 0.1%, reduced from the original rate of 0.4%. (Applicable by March 31, 2024)

– 3 – Costs to pay after purchase

(3-1) Real estate acquisition tax

The real estate acquisition tax is paid only once when purchasing a real estate property. The tax notice is sent within 6 months or a year after the purchase. The tax is basically calculated by multiplying the tax base amount by the tax rate. In principle, the real estate acquisition tax rate is 4%. For purchasing a primary residence, you can receive another reduction applicable for the acquisition before March 31, 2024. The reduced rate is 3% of the tax base amount, 1% lesser than the original rate.

Furthermore, in the calculation of the acquisition tax, a deduction applies to the assessed value of fixed assets under the following conditions. With the fulfillment of these requirements below, the deduction can be from 1 million yen up to 12 million yen based on the year when the house was newly constructed.

The conditions to receive the deduction are;

– The floor area must be between 50 and 240 square meters.

– The house must conform to the new earthquake-proof standards.

On-going costs (Costs incurred for ownership)

This cost is continuously incurred by owning the property after the purchase. The amount of these expenses may vary due to changes in law and arrangements of management associations.

Monthly expenses (if you are an owner of an apartment/condominium)

Maintenance fee, Repair fund

Annual expenses

Property tax (Fixed-asset tax), City planning tax (*if your property is in the designated area), Fire/earthquake insurance premiums

Purchase cost sample lists

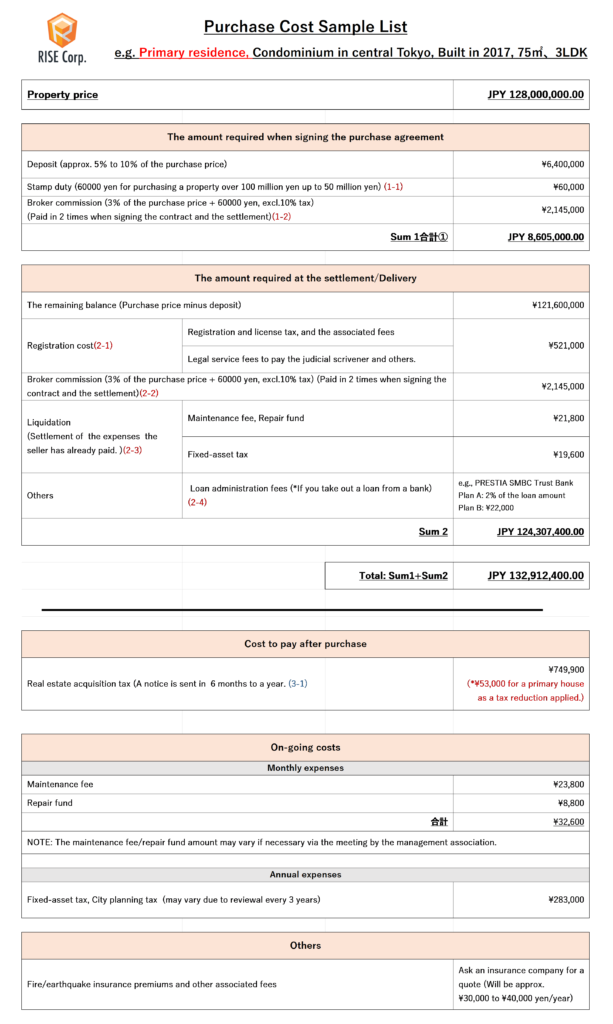

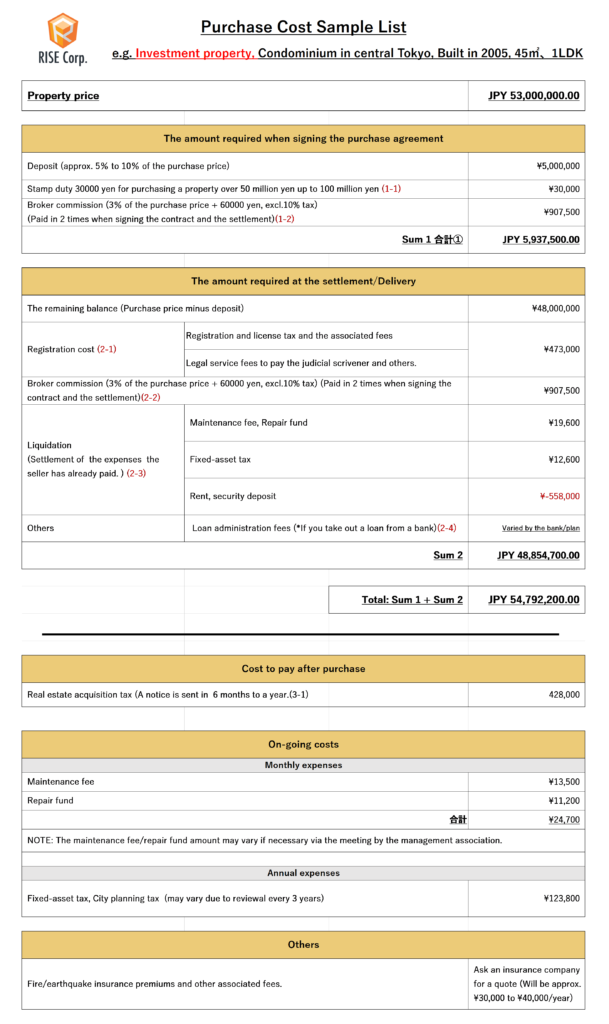

These samples show how much it will cost to purchase a real estate property. Please use them as a guide to estimate the total amount of costs combined with the purchase price.

The point is that the two samples have different tax rates based on the purpose of purchasing, for a primary residence (own personal house) or investment. The reduced rate for purchasing a primary house is applied to the Registration and license tax and Real estate acquisition tax.

Sample for Primary residence:

A condominium in central Tokyo, Built in 2017, 75㎡、3LDK